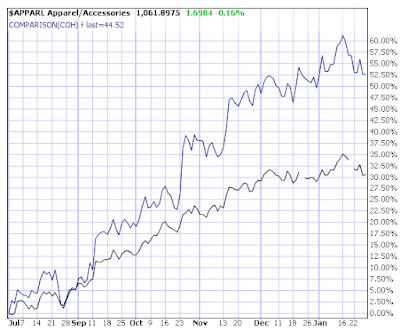

The Industry group is looking good in the green on the big chart. The group chart is pulling back a bit after a very strong move since July. In the last six months, COH has considerably outperformed its group.

If the market and this group continues with strength, it would be a good bet that this stock would remain a leader. They just came out with earnings beating estimates for the 5th straight quarter.

The fundamentals are looking very strong here. The 5 year annual growth estimate at 20% is a touch lower than we'd like, but the ROE(Return on Equity) of 40 is very favorable. The brief run down from the press on the earnings announcement looks pretty nice. Sales in Japan grew 17%, (I assume that's year over year) and they're adding 10 new stores in Japan for a total of 20 new stores in 2007. Using the estimate for annual earnings in the fiscal year 2007, it now has a PEG of 1.24, which is still pretty attractive for a leading stock.

The day of the earnings announcement there was some odd intraday action, but it formed a Dragon Fly Doji, much like a hammer, that was confirmed with a bullish engulfing candle the next day. This coincides with the MA acting as support as it did twice in December. While the trend has clearly flattened out a bit, an entry here would put us closer to support levels where we might choose to use for exit points to the down side. Considering the potential sideways action, one might be inclined to wait for a close above the 45 area, which has been a minor point of resistance lately.

So what do we do with this, particularly considering the market is looking a bit ify right now? Buying the stock here would be pretty reasonable since it is so near support. Even with the uncertainty in the market, a tight stop under 43.50 or 43 would be reasonable with a plan to use one of those two support lines as an exit. But where's the target? Obviously a near term target of the recent high at about 46 or 47 would be reasonable. And looking back at the average distance above the MA in the last two years, I'd say somewhere between 3-4 pts. With the MA now at about 44, I'd say 37 would be a reasonable near term target. But for a longer term trend ride, I can't see why at least a nice, round number like 50 shouldn't be in the cards. So to play it as a regular stock buy, you'd have to decide if you're comfortable with the risk/reward and whether or not you'd want to look for a quick profit or to let it ride for a longer term trend play.

But let's consider some ideas using options. There doesn't quite seem to be enough juice in the options chain to make a covered call buy-write very attractive. Look at how the IV dropped very quickly after the earnings announcement. You may remember my mention back in December that this could be a good stock to play a run up into earnings and the accompanying rising implied volatility.

Buying the stock now and selling the March 45 call for 1.50 would bring a profit, if called out, of under 5%. Depending on how close you'll choose a support level to use as an exit, that might not be the most attractive risk/reward. What would make it more attractive would be buying a deep ITM call instead of the stock itself.

Buying the May 32.5 for 12.80 and selling the Mar 45 for 1.50 would technically be a "Diagonal" spread with options from different months with different strike prices. But used this way, it is essentially like a covered call. This position would cost $11.30 and bring a potential profit of 1.20 or 10.6% return on investment. The real question is whether that profit is worth what we'd be risking if we sold on a break of support. I think it's pretty debatable. But don't forget about the possibility of selling the following month after March expires if we're still somewhere under 45. What I'd be more inclined to do along these lines would be to buy the May 32.5 and wait until the stock moves a bit higher to "leg in" to a covered call, selling maybe the 47.5 or even the 45 for a higher premium.

Looking at the potential with vertical spreads, hedged positions buying and selling different strike prices but in the same month, the bull-put credit spread doesn't have enough premium in it to make it worthwhile, even further out in March. Using the support levels we have beneath us, it'd be nice to sell the 42.50 strike price, but a 42.50/37.50 March put spread would only bring in .60 for a potential return of 13% on the money at risk.

But what if we looked at doing a vertical spread with directional bias. We can do virtually the same spread with either puts or calls, buying the 40 strike price and selling the 45.

Here is the options chain for these 5 pt. vertical spreads. Because they are 5 pts. wide, the most one can ever make or lose is 5 pts. minus the credit or debit of the spread you opened.

Looking at the Feb spreads, buying the 40 call and selling the 45 call will cost $4 with a potential profit of $1. If we use 42.50 as a trigger to get out of the trade all together, the loss would be about $1.50 because we know that the 40 call will have at least 2.50 of intrinsic value in it. Depending on how close it is to expiration, there might still be enough time value in the combined position to make the loss less than that. Of course, you could use 43 as the trigger to get out or even 43.50. But giving it room to move with a trigger at 42.50, we're risking about 1.50 to make 1. That's not bad at all considering the high probability of the win. The stock only needs to move up .50 in the next 18 days to get full profit. Notice that the same position in puts, the Feb 40/45 put spread, selling the 45 put and buying the 40 put will bring in a credit of $1, exactly the same.

If we want to be a touch more conservative we could give it more time. Using a March spread will both give us more time for the stock to go where we want it and will get us a better profit potential(and smaller potential risk) because there is more time value(fluff) built into the options we would be selling.

Buying the March 40/45 call spread costs 3.70, leaving a potential profit of 1.30, the balance of the 5 pt. spread. But selling the March 40/45 put spread would bring a credit of 1.40, a better potential return on the money at risk.

Investools seems to teach credit spreads as something to be used only selling the short strike price out of the money and behind support of some kind. But notice here that the credit spread that is actually a bit in the money here is more attractive than the debit spread. Also, one of the benefits of the credit spread(though very dicey) is that you can "reverse" the trade.

For example, with the March put spread, we'd be buying the 40 and selling the 45. If the stock suddenly broke through support in a dramatic way and with volume, we might expect it to go much further. We would then have a few choices: We could close the whole position for a loss. Or we could buy back the 45 put for a loss and let the 40 put pick up value as the stock continues to fall. If it goes far enough, the profit from the 40 put will compensate for the loss taken on the 45 and we might even end up with a net profit on a trade that went the wrong direction.

I want to emphasize that this type of trade reversing is very tricky and has further risk involved, but it's something we should understand as a possibility going into a trade. I'll do a post soon about a trade reversal I made on BHI. It was a successful fix, but more often than not I've screwed things up worse when I've tried that.

In conclusion, it seems to me that this is a tough options chain to deal with because there's not a lot of fluffy premium to sell. I would probably be more inclined to buy the stock or a deeper ITM call and look to leg into a covered call or diagonal spread. Or doing the March 40/45 bull-put credit spread(slightly in the money) for a potential 38% return on risk if the stock moves up .48 by March expiration.

I hope that all wasn't too confusing. There have been very comments/questions left on this blog. If any of this is confusing or brings up questions or thoughts to share, please do not hesitate to write them in the comments section below.

In other news, ZMH reported solid, estimate beating earnings today after the close and raised the outlook for 2007. Strangely, before the announcement, the market had already begun a strong bounce off the MA and trendline support for a break above resistance on volume well above average. Perhaps people are really interested in this one. Industry group is in the red on the big chart, though the group's chart looks quite strong still.

The F/E score is just at 3.25 our minum with the Estimates score at 2.75. Not quite the forward looking strength we'd like to see. Can you account for why the Estimate score is that low? I can. How to figure out the scoring is in your manuals.

Our old friend ISE appears to be following through with the double top pattern, if a bit sheepishly. I'm pretty sure I've mentioned this pattern on this stock a few times already. Earnings come out Feb. 5, so use caution before then.

Notice the little note I put on the chart. On 1/22 I bought a March 50 put. Looking at the chart action, I chose 47.50(around where the MA was) as a bail out point but got out early because the candles seemed to be telling me that support at 45 was going to hold. I closed it 1/26 for a small loss after seeing a morning star formation at support and then a Hammer on the day I closed it. Perhaps I should have waited for confirmation on the hammer with a close higher. That didn't happen. It went lower and I would be profitable right now. Grrrrrrr!

Lots of important economic announcements this week, especially the FOMC meeting statement on Wednesday. So be careful out there.

No comments:

Post a Comment