I am still in the process of putting together a step by step run down on my approach to creating a bull watchlist. In the meantime, here's a quick and dirty run down on how I/we came up with the resulting additions to the current watchlist.

First, I ran a Power ProSearch with the following Criteria:

(click images to see them larger)

From the resulting list, I check only those stocks whose charts look neutral or strong with potential for new buy signals in the near future. Those stocks were saved as a temporary watchlist.

From that list, I eliminated any stocks whose group charts were not at least neutral in the last 2-3 months. I also tagged any stock whose group was looking very bullish for added emphasis on those stocks.

Next came the much more subjective and somewhat "artistic" part of the process. Widdling it down by valuation (PEG no higher than 2 but the lower, the better), relative strength in the chart compared to the group and the market, and various newsy considerations.

Here's quick few words on the appeal of the new additions:

CBI - Strong and healthy looking chart, constructive group chart, PEG 1.5

CHK - We needed Oil & Gas Producers group representation and this chart looks consistent with that group chart, holding up better than oil services. PEG of .55, very low. Low P/E compared to its group. And finally, as a major natural gas company, if

natural gas continues to test the 8.5 level as it has in the last year and finally breaks it, this stock will no doubt respond favorably.

Long term chart looks quite nice. Sideways for quite a while there and now moved above that level for sure.

CYBS - PEG of 1.64(at the time, now 1.76), but using the next fiscal year estimate instead of the 5 year estimate, the PEG is much lower. Growth estimate for fiscal year ending 13/31/08 is 56%. That's pretty serious, particularly with a P/E currently of 44. Group chart could be stronger, but it's certainly not bearish. But the stock's chart itself looks fantastic. Big volume gap up on earnings in Oct. Settled back into support and looks to be trying to break above this consolidation area. About 15% of float share are short, so that could make for some nice short squeeze potential. (Of course it also says something about the market's confidence in this stock.)

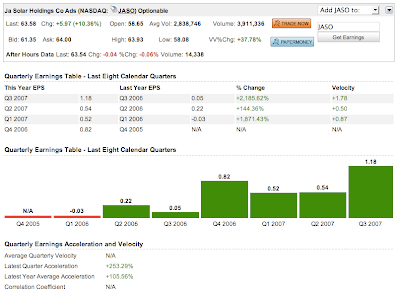

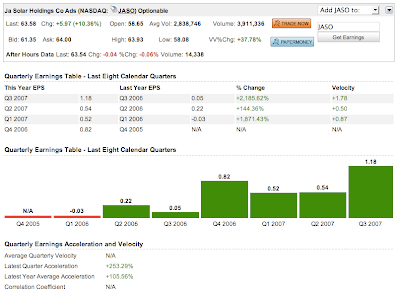

JASO - Though grouped with with the semiconductors, this is a china-based manufacturer of solar cells, selling mostly to china, but also Germany, Sweden, Spain, South Korea and the U.S. Solar stocks have been showing themselves as the real deal, it seems, and this one supplies some of the stronger companies. ROE of 28 is quite nice. PEG of right around 1 and about .75 using the growth estimate for next year instead of the 5 year growth estimate. Perhaps it's a bit early to feel super confident in the consistency, but the quarterly growth is noteworthy.

Very strong looking chart.

PRGO - I like the looks of the Biotech group knocking hard on resistance. PRGO had a huge volume move up. Maybe a bit far a bit fast, but after it consolidates a bit as it is doing, could be a nice mover yet. PEG - 1.57, but again even better using next year's growth instead of the 5 year estimate. Very low P/E compared to its group. Regardless, the recent breakout is quite bullish. Those two days were on about 4X the average daily volume.

SNDA - China online gaming stock. ROE of 50! Earnings growth has been remarkable, yet the P/E is only 15 with a 20% growth estimate. PEG of less than 1! This type of valuation is fairly consistent with most of these promising china stocks, so perhaps there is more risk here than we know. Nevertheless, the chart looks good. Paused for consolidation in the last two months. Pretty big volume earnings jump in late Nov. Resistance at 40 looks bound to be broken soon.

STLD - The Iron and Steel group looks quite strong and this stock looks right in step with pushing its high. PEG of 1.79(though this comparison is apparently less useful or consistent with commodity stocks due to volatility of the underlying commodity). Very strong growth estimate for next year compared to the group. P/E just under the group average.

Very nice chart.

Wildcard: LIFC - This is a "wildcard" because it doesn't have our required 500K average daily volume. Not yet, at least, and just barely under.

Again, I like biotech, though I think this stock may be better suited to some other kind of medical tech. group. Anyway, very strong sales and earnings growth last year. PEG getting up there at 1.85. But Quarterly earnings growth has been quite consistent.

Strong chart. Nice daily volume this past week on the breakout above recent highs.

I should bring attention to one potentially dodgey issue and that is that there are quite a few china stocks on our list. CMED, JASO, MR, SNDA. Not too similar in their businesses, but China nevertheless. I tend to think it more reasonable to place less emphasis on the groups they are placed with and more on a comparison to the China stock market. I use the FXI.

Let's hope all the new recruits turn out to be great additions.