Here is the Market Posture Grid as filled out at Thursday night's meeting.

(Click on image to see it bigger.)

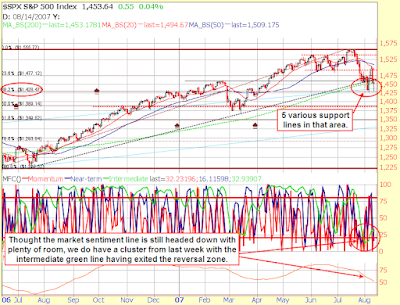

Below is the weekly chart for the SPX. It's hard not to notice that there is a very clearly formed double top formation in process. But like any pattern, it's just a potential pattern until it is complete which is when the support line is broken in this case. It's also very apparent that the higher high is less of an improvement than the previous higher highs. Same with the higher low, and on the daily chart it's more of an equal low. Nevertheless, the intermediate posture on the SPX is still arguably neutral due to no major lower low and still having no major lower high despite the clearly bearish short term trend. What further supports an at least neutral intermediate posture and potentially bullish short term posture is what looks like a possible short term reversal at significant support. This week's candle is clearly bullish(engulfing and then some).

Thursday night we spoke about potential points of resistance to look for in this market rally. Having been a very significant point of support and resistance many times in the last five months, 1490 seems the most obvious level. Interesting to see the rally peaked out just a dollar short of there intra-day on Friday.

The weekly VIX chart also shows some reason to be bullish at least for the time being. The long term trend in the VIX is clearly up and this is a long term bearish indication, but remember that it is the intermediate and to some extent short term that we should be most aware of, as the "long term" shows us what has happened somewhat long into the past. The Intermediate and short term will give us a better idea of what to expect for the immediate future.

On an intermediate time frame, we have a lower high even if just slightly, and a lower low from mid August to late September. Looking a the bearish reversal candles in beginning November, we see that they have been confirmed in the past week's lower close. Furthermore, this week, we got the important piece of the puzzle we were waiting for which was a lower low on the short term VIX, a movement below daily support(and former resistance) just below 24.

For the final component of the Market Posture routine as taught by Investools, the Market forecast is giving us a clear bullish reading on the intermediate term with the green intermediate line having moved upward out of the lower reversal zone.

There is also seen one of the major "signals" that the Market Forecast indicators give which is the "Near Term Divergence." This is where the blue Near Term line puts in a higher low while the SPX itself makes a lower low(opposite for a bearish divergence). As with any signal, it doesn't tell the future or work out every time, but in this case it has worked out at least short term.

It's hard not to feel the fear in the air and even to notice that the SPX is still under the 200 MA even with the rally of the past week. I'll let you do the process with the Nasdaq, but it's interesting to note that doing the three pronged posture in as objective a way as we could, we came up with a Bullish posture for the Nasaq and Neutral for the SPX and only then looked to note that the SPX is below the 200 MA and the Nasdaq is above it. Perhaps it is not earth shattering news, but noteworthy nonetheless.

There are certainly lots of things to be worried about with the economy and even the charts. But there are also potentially positive factors for the market, so who knows?

I won't list the negatives, but as for a few potential positives from one who is FAR from an economics guy, how about oil prices finding a potential top?

How about the weekly bearish engulfing on the Yen at long term resistance? It may be short lived, but it looks like it needs to come back in a bit before moving higher if that's going to happen.

How about the plunge in the US Dollar coming to a halt at least for a while as is shown possible by the bullish engulfing candle on the weekly chart? It's awfully far from the 40 week MA.

This may be grasping at straws, or however that saying goes, but the home builders have just been relentlessly hammered for a long time. Even if the outlook is still far from rosy for them, an end to the plunge is inevitable at some point. We know that all homebuilding in the US will not come to a complete stop and therefore the homebuilders will not go to zero. (All you gloom and doomers, yes the apocalypse is the exception.) Though far from a convincing bounce just yet, we do have a bullish engulfing at an old support level and even bullish divergences on both the MACD lines and the MACD histogram. I can't remember who, but I believe someone from the big name investors out there announced taking a major position in one of the homebuilders this week.

For an even more thorough feel of what "The Market" is doing, I encourage you to build a watchlist of the Sector Spiders. 9 ETFs that as a general snapshot show you the action of the market in 9 clumps of related stock groups. There are many ways to look at the sectors of the market and the "sectors" seem to be defined differently by all, but this seems about as quick and easy as any. Notice that the XLF put in a monster bullish engulfing on the weekly chart with its highest weekly volume to date.

I do realize that my showing only the positives and not the negatives seems an awful lot like being a bullish cheerleader. But really, I just want to focus on the positive a bit, because all we've heard about lately is the negative.

There is, without a doubt, downward pressure on the SPX and tough resistance at 1490 even with this week's rally. I will look to 1430 (support from the inverted head and shoulders in August) for a potential level of support. Just about all of the above will probably be null and void with a decisive break below 1406. With a real break below 1375.......Look out below.