Though the breakout to recent highs did breakdown and ultimately "fake out" fairly quickly, there is still a strong and in tact long term uptrend with a trend support line just below us. If that doesn't hold, the next likely area of support would be 12,750. After the recent craziness and fear as high as I can remember in recent years, is the Dow really likely to fall another 500 points in the coming weeks? Remember, the crowd usually gets it wrong, or so they say. I suppose it's possible this level will break and the quick drop to 12,750 could happen. After all, it's really only 4% and would actually finally achieve the 10% correction that so many have longed for. But again that is a strong and healthy long term uptrend in 30 mammoth stocks that don't just get going or turn on a dime. Even if we are destined to test that area for an "official" correction of 10%, the past two weekly candles are pretty major inverted hammers, showing an inclination to bounce. We shall see.

SPX is also still in good looking long term uptrend, though the breakdown after the fake out of the trading range at the top does seem a bit more severe. The trend line from the mid '06 lows is pretty much broken. But there is almost surprising support from the old channel resistance line in blue. Also the weekly candle shows an inverted hammer like the Dow. If this area doesn't hold, the next likely area of major support is 1,380. After that, all the way down to 1,325. The first level would be roughly an 11% correction from the top, the second would be almost 15%.

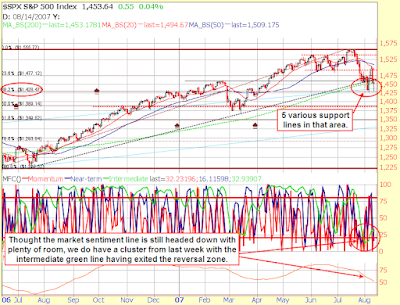

For a closer look at the SPX, I'm going to be a bit obnoxious and put up a chart with way too many indicators and lines. Basically, I just don't want to do a third SPX chart. One thing that I think is quite interesting, though I'm no Fibonacci pro, is that the low from last week that provided intraday support again this week is right on the 38.2% Fib retracement line, the first of the most significant retracement levels. The 200 MA is also providing support in addition to the diagonal and horizontal support lines present on the weekly chart. In total, there are 5 support lines of one kind or another, including the fib line, around the current price.

The Market Forecast indicator is actually quite bullish, save for the longer term sentiment indicator, which is heading down with plenty of room to go. But after last week's cluster, the intermediate term green line has exited the lower reversal zone for the official green light on playing the cluster. To strengthen the bullish argument being given there, the momentum and near term lines are lining up for a nice "Intermediate term confirmation" signal, another of the signals Investools teaches on these indicators. In short, the two shorter term indicators line up to be the wind at the back of the intermediate term line.

In short, I'm expecting a bounce here. But the real test will be when the index tests the bottom side of the old support and recent resistance line at the 1490/1500 area. If that holds as resistance, we'll likely see some serious sideways choppy action for a while or possibly another leg down and potential beginning of an intermediate term downtrend.

I think I showed VIX with a weekly chart last time, so I'll just stick to the daily. It's rocketed only higher and seems very likely to come in some. Even if it is destined to go higher, there needs to be some kind of retest of the new range support. I just can't imagine the VIX going parabolic without a true market crash happening. Regardless, it is clearly telling us that fear is high right now. It's also telling us to be on our toes for a peak, as once it is high and then turns, THAT is the time to buy. So my take is that this is very close to being a bullish indicator right now. One point of interest from this past week is Wednesday's action. Though the SPX had a big strong up day, the VIX did not have an impressive down day and actually couldn't break below the recent support/old resistance level at the 20 area. I took this at the time to mean that the up day in the SPX was not to be trusted because people were still buying puts heavily. But really, just look at that Doji star hanging up there. Can it really go higher in the next few days? Of course it can. But is it likely? I doubt it.

The Russell 2000 small caps index has shown much relative weakness in recent weeks, but this week was quit strong. With what we could call a bullish engulfing weekly candle, it seems to not want to give up these support lines, both diagonal and horizontal.

With all the talk about how strong the Big Caps are, could this be the time to get into small caps? The long term view seems to indicate so.

Again, I'll leave the Nasdaq up to you. But here's my thinking. The Dow still shows the most relative strength. The SPX, with many more components to it, is still strong in a long term sense, but the short term is looking a lot more shaky. If the Russell and the small caps bounce from here, the small caps may finally wake up and actually provide a bit of support to this market. I would think that would only help the SPX regain its composure next to the Dow.

Take a look at the Nasdaq versus the Nasdaq 100(NDX). The NDX looks stronger than the composite as a whole, which makes sense considering the NDX is the 100 big boys. If the smaller guys, many of which are surely in the Russell 2000 can get it together, perhaps the Nasdaq composite can work its way through the congestion of "overhead supply" it has to deal with.

Any comments? I dare you.

Bueller?